Have trouble saving money? You’re not alone. 58% of Americans have less than $1,000 set aside in a savings account, according to a recent report by Statista. And that’s just not enough to cope with life’s major expenses – such as college tuition, medical bills and housing, to name but a few.

That’s why today, we’re tackling four pervasive myths that discourage people from saving.

Myth #1: Saving is for people who have more money than I do.

Saving is for everyone. Young or old, financially secure or still working things out, everyone can benefit from a fallback fund. Even if you can save only a small amount, those gains will add up over time. Having some money saved is always better than having none.

And it pays to start today. Axiom Bank recently introduced a new savings account that offers a competitive rate. You can put your money to work today by walking into one of the 21 Axiom branches and opening a Big Savings account with a $25 deposit.

Myth #2: Saving can wait; I need the money now.

From clothing to household items to car maintenance, you’ll never have a shortage of routine expenses. But when the time comes for big, unexpected costs like hospital bills or college tuition, access to savings will be a necessity, not a luxury.

If you have small outstanding debts like a credit card balance, pay them off as soon as you can. Then, sit down with your budget and see where you might reduce – or eliminate – costs.

Myth #3: Saving requires a complicated budget.

Not at all. An easy place to start is the 50/30/20 benchmark. Calculate your total income and set aside half of that for necessities like rent, mortgage, or utilities. 30% can be spent at your discretion on day-to-day purchases. The remaining 20% should go into savings.

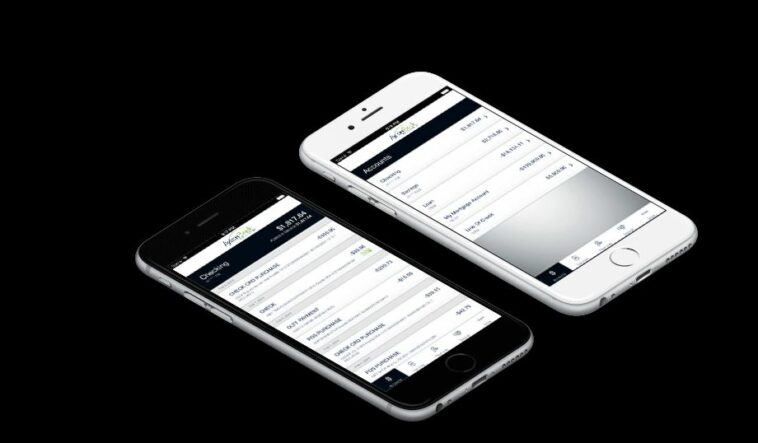

If pulling together all your receipts and bills still sounds intimidating, try online and mobile banking with Axiom Bank. You’ll be able to easily view all your transactions in one place, so it’s easier than ever to track your finances.

Myth #4: I can only save a little, so it’s not worth it to have a savings account.

There are a lot of benefits associated with a savings account. For one thing, your funds will be secure from theft or fraud until you need them. Plus, you won’t be tempted to spend beyond your budget.

By making automatic deposits into your savings account, you can take the stress – and the willpower – out of saving. With Axiom Bank’s Big Savings account, depositing $21 a week will give you a nest egg of $1,042 at the end of your first year. That’s already more than the average American has in savings, and it’s the first step on the path to feeling secure in your finances.

Don’t let misinformation stand in the way of your financial wellness. By getting in the habit of saving now, you’ll boost your resilience and fund a brighter future.

About Axiom Bank N.A.

Axiom Bank N.A., a nationally chartered community bank headquartered in Central Florida, provides retail banking services, including checking, deposit, and money market accounts. It also offers commercial banking services, treasury management services and commercial loans for real estate and business purposes.

Comments