As unemployment in the United States soars to 14.7%, and experts predict a second wave of COVID-19 cases, it’s clear that many people will be effected by the economic consequences of the pandemic for a while. Many of us have already adapted our lifestyles to this “new normal” – but now is the time to adapt your budget, too.

Of course, that may be easier said than done. Here are five steps to get started:

1. Don’t panic.

If you are out of work, furloughed or unemployed due to COVID-19, it’s natural to feel anxious. Staying calm and planning ahead is key – and it can help you prevent problems before they arise.

Sit down with your account statements and a spreadsheet (or pen and paper, if you prefer). List every expense and source of income for your household, including debts. Be as thorough as you can: You’ll use this as the framework for your budget.

2. Address basic needs first.

If your income has been reduced by COVID-19, your expenses will need to be reduced too. For some households, this may mean making tough choices and whittling down to the essentials. If, for example, you’re struggling to cover your utility bill, check with your provider; many offer emergency assistance or payment programs.

3. Confront debt early.

Debt management should be classified as a “need” in your budget, on par with your utilities bill. That’s because falling behind on payments can cost you more and harm your credit over the long term. Fortunately, some lenders are offering COVID-19 payment deferrals – allowing borrowers to pay later without incurring interest. If you’re not sure you can pay your debts on time, contact your lender as soon as possible and ask what relief options are available.

4. Save what you can.

Not everyone is in a position to save money right now – and that’s okay. But for those who are able, the next step should be to set aside a portion of your income to an emergency fund. When problems arise, you’ll be better equipped to cover bills, repairs and living expenses without resorting to debt.

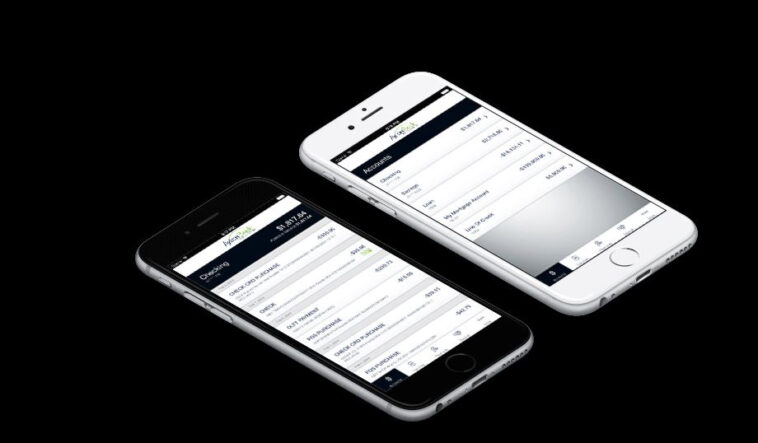

If you can, try to save 20% of your income. But the bottom line is that any amount saved is better than nothing – even a few dollars at a time. To keep your emergency fund separate from your other expenses, consider setting up a savings account, like those offered by Axiom. Thanks to free online and mobile banking, you’ll be able to access your savings quickly, securely and remotely.

5. Budget for a new normal.

Even when COVID-19 is behind us – and there’s not yet a clear indication of when that will happen – the economic impact of the pandemic is likely to linger. Take the long view when you create your budget. Consider factors like housing, college savings and even retirement. Above all, be sure that you’re building a budget that is sustainable.

Remember, financial planning isn’t something you do once – it’s an ongoing process. By revisiting your budget on a regular basis, you can overcome today’s challenges and be ready for tomorrow’s.

About Axiom Bank

Axiom Bank N.A., a nationally chartered community bank headquartered in Central Florida, provides retail banking services, including checking, deposit, and money market accounts. It also offers commercial banking services, treasury management services and commercial loans for real estate and business purposes.

Comments