In the vibrant landscape of Virginia’s real estate market, Debt Service Coverage Ratio (DSCR) loans emerge as a pivotal financing tool for investors keen on leveraging opportunities without the constraints of traditional lending criteria. Unlike conventional mortgages that rely heavily on the borrower’s income, DSCR loans assess the potential income generated by the property, offering a more flexible path to property investment and ownership. This innovative approach ensures that investments are not hindered by personal financial limitations, enabling a broader range of investors to enter the market.

The importance of real estate investments in Virginia cannot be overstated, as they contribute significantly to the state’s economic growth, provide substantial returns to investors, and enhance the overall housing quality. In this context, a DSCR loan in Virginia is a key enabler, empowering investors to capitalize on the state’s real estate offerings with greater ease and flexibility.

Understanding DSCR Loans: Basics for Virginia Investors

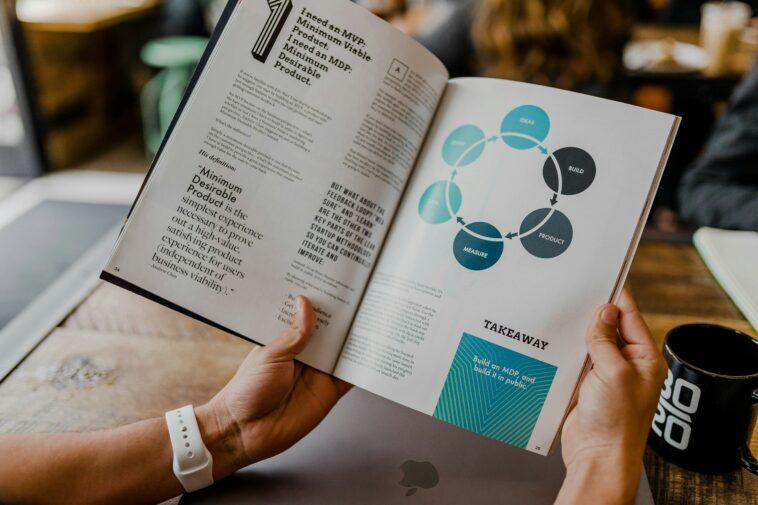

DSCR, or Debt Service Coverage Ratio loans, redefine real estate financing by focusing on the income a property generates rather than the investor’s personal income. This type of loan calculates the ratio between the property’s annual net operating income (NOI) and its annual mortgage debt service, including principal, interest, and other fees. A ratio of 1 or above is typically preferred, indicating that the property generates sufficient income to cover its debt obligations. This methodology offers a distinct advantage, especially in Virginia’s diverse real estate market, by providing a more accessible financing pathway for investors whose personal income might not meet traditional lending standards.

The advantages of DSCR loans over traditional financing are manifold. They allow quicker approvals since the focus is on the property’s income potential, not the borrower’s financial history. This can be beneficial in competitive markets like Virginia, where swift action can be the difference between securing and losing a promising investment. DSCR loans often require less documentation, and the property serves as the primary criterion for loan approval, simplifying the investment process.

Why DSCR Loans are a Good Fit for Virginia’s Real Estate Market

Virginia’s real estate market is ripe with opportunities, from the high-demand areas of Northern Virginia, close to the nation’s capital, to the historic streets of Richmond and the coastal attractions of Virginia Beach. Each area offers unique investment prospects, from luxury urban condos to beachfront vacation rentals and suburban family homes. DSCR loans are particularly well-suited for Virginia investors due to the state’s strong rental market and potential for property appreciation. These loans offer the flexibility to invest in various properties, including multi-family units, single-family rentals, and commercial real estate, making them an ideal tool for expanding an investment portfolio across the Old Dominion.

Exploring Virginia’s Real Estate Investment Opportunities

Virginia’s real estate market is as diverse as its landscape, offering many opportunities for savvy investors. With its proximity to Washington D.C., Northern Virginia boasts a robust rental market driven by a steady influx of professionals and government employees. Here, investors can find high-value properties with the potential for strong rental yields. Richmond, the state capital, combines historical charm with a growing economy, making it attractive for residential and commercial investments. Meanwhile, Virginia Beach offers unique opportunities for vacation rentals, with its popular beaches drawing tourists year-round.

The types of properties ideal for DSCR loan financing in Virginia vary widely, encompassing everything from urban apartments catering to young professionals in Arlington to vacation homes along the Atlantic coast. Multi-family properties in college towns like Charlottesville also present lucrative options, benefiting from the consistent demand from students and faculty.

How to Qualify for a DSCR Loan in Virginia

Qualifying for a DSCR loan in Virginia hinges on the property’s ability to generate income, with lenders typically looking for a DSCR ratio of 1.0 or higher, indicating that the property earns enough to cover its debt. To improve your DSCR ratio, consider strategies such as increasing rent where feasible or reducing operational costs to boost net income. Essential documentation often includes property financial statements, lease agreements, and a comprehensive appraisal. The process involves evaluating the property’s income potential rather than the borrower’s personal income, with a focus on the real estate market’s specifics in Virginia.

Future Trends in Real Estate and DSCR Loans in Virginia

The Virginia real estate market is expected to continue its growth, with a trend towards more diversified investment portfolios. DSCR loans are poised to play a significant role in this landscape, offering flexibility and access to capital for investors. As the demand for rental properties increases, especially in key urban and coastal areas, DSCR loans will become an even more attractive option for financing investment properties, adapting to market changes and investor needs.

Comments